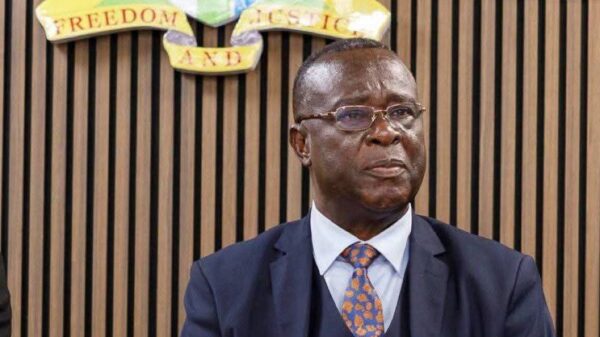

Finance Minister Dr. Cassiel Ato Forson has announced a major recovery and recapitalization effort at the National Investment Bank (NIB), which he says has preserved GHC6.4 billion worth of depositor funds and saved over 900 jobs.

Delivering the 2025 Mid-Year Budget Review in Parliament on Thursday, July 24, Dr. Forson said the intervention forms part of President John Mahama’s broader commitment to safeguard Ghana’s financial institutions and protect the interests of Ghanaians.

“By taking these major steps, we have preserved depositors’ funds valued at GHC6.4 billion. We have also saved over 900 direct jobs at the National Investment Bank,” he said.

He blamed the previous New Patriotic Party (NPP) administration for what he described as the near-collapse of the bank. According to him, by the end of June 2024, the NIB had a capital adequacy ratio of negative 53.31%, despite the NPP spending GHC30.3 billion on its financial sector clean-up exercise.

“Mr. Speaker, President Mahama and the NDC have successfully recapitalized the NIB by implementing an ambitious and credible plan to return NIB to profitability and sustainability,” he stated.

Dr. Forson explained that the government injected GHC450 million in cash into NIB, issued re-marketable bonds with a face value of GHC1.5 billion, and transferred GHC500 million worth of Ghana’s shares in Nestlé Ghana Limited to the bank. These efforts, he said, significantly turned the bank around.

“These transfers have significantly increased the capital adequacy ratio from negative 53.13% at the end of December 2024 to a positive 23% in May 2025,” he told Parliament. “Mr. Speaker, we have preserved an indigenous Ghanaian bank.”

Taking a swipe at the previous administration, Dr. Forson added, “Unlike the NPP government that chose to spend to collapse a bank, the NDC government chose to spend to save a bank.”

Looking ahead, the Finance Minister revealed that a comprehensive restructuring plan has been drawn up to ensure NIB’s long-term stability and growth. The plan aims to strengthen corporate governance, reinforce risk management, improve operational efficiency, and ultimately list the bank on the Ghana Stock Exchange.

“Speaker, this plan will, among others: strengthen corporate governance framework and systems; improve enterprise risk management and controls; establish a modern business model; revamp operational strategy; improve financial performance; institute enhanced supervisory measures; and eventually list NIB on the Ghana Stock Exchange,” he said.

He concluded with a bold reassurance to Ghanaians: “More importantly, Mr. Speaker: NIB is back! NIB is now liquid! NIB is now safe! NIB is now fully capitalized! We, therefore, encourage all and sundry to do business with the revitalized National Investment Bank.”