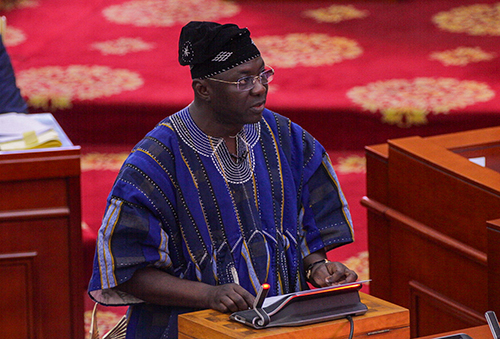

In an address before Parliament, former Finance Minister Dr. Mohammed Amin Adam highlighted the transformative impact of digital innovation on revenue mobilization in Ghana. Speaking on the importance of digitalization in enhancing tax collection and compliance, Dr. Amin Adam reaffirmed that technology-driven solutions have significantly contributed to the country’s improved revenue performance.

The Role of Digitalization in Revenue Collection

Dr. Amin Adam stated, “Digitalization really has come to stay, and the contribution of digitalization towards enhancing revenue performance, both in the area of revenue collection and also in the area of compliance, is evident in the numbers that we see in our revenue.”

He acknowledged the strides made through key digital measures such as the Ghana.gov payment platform, electronic invoicing for VAT (E-VAT), and the iTAX system. “These have all contributed to raising the levels of revenue that we have collected,” he said.

Referring to a report from the Institute for Fiscal Studies, he noted, “As of 2022, our tax-to-GDP ratio was about 13.8%. This is far below the 18% we are supposed to be achieving by 2027. However, over the last two years, the government has achieved so much that we are very close to achieving the 18% before even 2027.”

He further revealed, “As of the end of last year 2024, tax-to-GDP ratio was 17%. We took it from 13.8% in 2022 to 17% as of December 2024. That’s very significant. And that is moving from 75 billion Ghana Cedis to 154 billion Ghana Cedis.”

A Call to Sustain Progress

The former minister urged the newly appointed Finance Minister to continue implementing digital solutions. “I want to invite the Minister, the new Minister for Finance, to continue to pursue these policies and measures to achieve the tax GDP ratio of 18% this year and not 2027, because that is possible,” he emphasized.

He further outlined key measures to strengthen tax compliance, stating, “Making tax digital requires a number of measures. One is the faceless tax assessment and filing of taxes, two is to ensure that businesses and individuals keep digital tax records, and the third one is to simplify tax audits in order to improve compliance. This is what the iTAX referred to in the statement is intended to achieve.”

Leveraging Local Fintech Solutions

Dr. Amin Adam also advocated for a local content policy to guide the adoption of digital tax solutions. “There are local fintech companies that are producing solutions that we can use to achieve our digital objectives. These local fintech companies have been used over the last three years, and we have been able to implement those solutions they have produced to bring us this far,” he noted.

He stressed the importance of supporting homegrown solutions, stating, “I want to encourage them also to come out with a policy, a local content policy that will guide the utilization of local fintech companies rather than sourcing these solutions from abroad.”

Digitalization: A Path to Economic Transformation

Drawing from recent discussions at the Africa Prosperity Dialogue, he underscored, “President Mahama alluded to this when he said that digitalization is critical for Africa’s economic transformation. And this is just a vindication of what the venerable Dr. Mahamudu Bawumia has been pursuing over the last three to four years to ensure that digitalization becomes a vehicle for the advancement of the Ghanaian economy for the benefit of the people of Ghana.”

Dr. Amin Adam concluded by thanking the initiator of the discussion, Hon. Kennedy Osei, for bringing attention to the critical role of digitalization in revenue mobilization. “I thank the maker of the statement for this very important statement, and I thank you, Mr. Speaker, for the opportunity to contribute to this discussion,” he said.