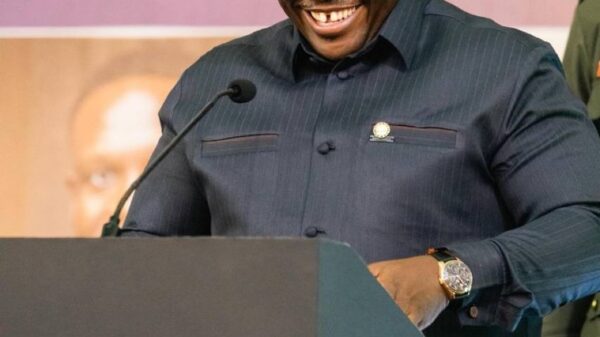

Finance Minister Dr. Cassiel Ato Forson has announced that the government will scrap the COVID-19 Health Recovery Levy and the VAT Flat Rate Scheme as part of a broader effort to reform Ghana’s tax system.

Speaking in Parliament during the 2025 Mid-Year Budget Review on Thursday, July 24, Dr. Forson said the Ministry of Finance aims to complete a new VAT Amendment Bill by October 2025 and submit it as part of the 2026 Budget Statement.

“The Ministry of Finance hopes to complete this process by September 2025, prepare a new VAT bill by October 2025, and submit the same to Parliament,” he told lawmakers.

Among the major changes, the Minister confirmed that “COVID levy will be abolished,” and that the “effective VAT rate will be reduced” to lessen the burden on consumers and businesses.

He also disclosed that the cascading effect caused by the GETFund and NHIS levies would be removed to create a more streamlined VAT system. “The punitive cascading effect of the GETFund and NHIS levy will be removed,” he said.

Furthermore, Dr. Forson revealed that the VAT Flat Rate Scheme, a simplified method for calculating VAT that is often criticized for distorting input credits, will be eliminated and replaced with a unified VAT rate.

“The VAT flat rate will be removed. And a unified VAT rate will be implemented,” he said.

To support small businesses, the VAT registration threshold will be raised to exclude micro and small enterprises from mandatory registration. The government also plans to boost compliance through “public education, awareness creation, and the introduction of physical electronic devices.”