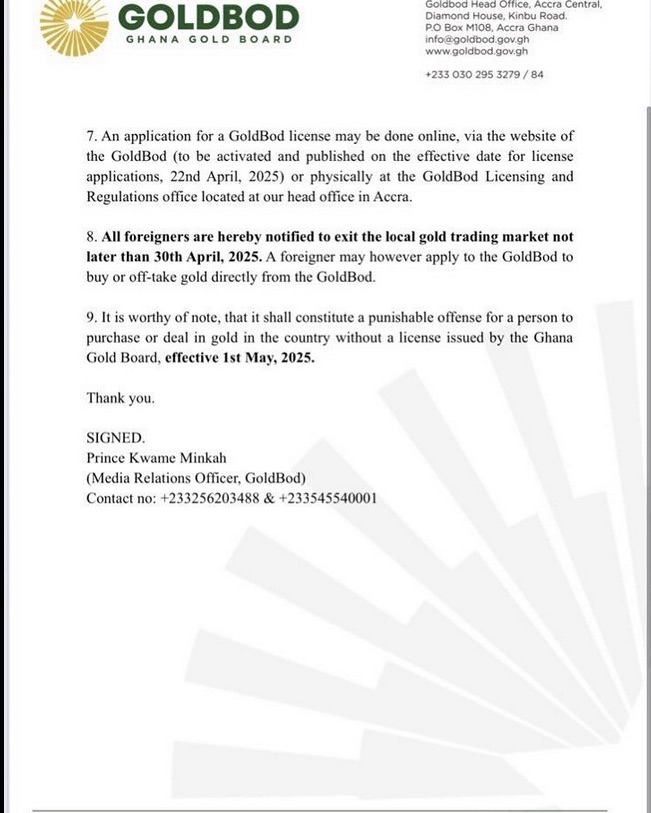

A recent announcement from the Ghana Gold Board (GoldBod) has brought major changes to the country’s gold industry, especially for foreigners involved in gold trading and export. The press statement, dated April 14, 2025, reveals that all licenses previously issued by the Precious Minerals Marketing Company (PMMC) or the Minister responsible for Mines are no longer valid except for those held by large-scale mining companies. This move is part of a broader shift under the newly passed Ghana Gold Board Act (Act 1140), which was approved by Parliament on March 29 and signed into law by the President on April 2, 2025.

Under the new law, GoldBod becomes the sole authority responsible for buying, selling, assaying, and exporting gold produced by Ghana’s Artisanal and Small-Scale Mining (ASM) sector. No other individual or organization is permitted to export gold from this sector. In addition, within the local market, only GoldBod and its approved buyers, aggregators, and service providers are authorized to engage in the gold trade. This means that many individuals and companies, especially foreigners who previously held valid licenses from the PMMC or Ministry, are now excluded from the sector.

While the statement does not directly mention foreigners, the implications are clear. Foreign individuals and companies who were legally operating under the old licensing structure will be affected. They are no longer allowed to export gold from Ghana unless they do so through GoldBod. Moreover, the release states that only Ghanaians or companies that are fully Ghanaian-owned can apply for new licenses under the revised law. This suggests that foreigners will not be eligible to apply for licenses on their own.

A transition period has been provided to allow existing license holders to wind down operations. Until April 30, 2025, they may continue to buy and export gold. After that date, all such activities must go through GoldBod. Furthermore, the government now requires that all gold purchases be made in Ghana cedis, with prices determined by the Bank of Ghana’s official reference rate. This change is likely aimed at stabilizing local currency usage and ensuring more oversight over pricing.

For foreigners who wish to remain active in the gold sector, options will be limited. The new structure appears to encourage partnerships between foreign entities and Ghanaian-owned companies, as well as the possibility of working under GoldBod as a service provider. Still, the changes represent a significant disruption for many and will require a careful reassessment of business strategies.

Ghana’s decision to centralize control of its ASM gold trade under a single authority marks a turning point for the industry. The emphasis on Ghanaian ownership and the elimination of foreign-held licenses reflect a move toward protecting national resources and strengthening regulatory oversight. While the long-term effects of this policy shift remain to be seen, the immediate impact is clear: the gold business in Ghana is changing, and foreign participation is now tightly controlled